Virtual Reality Banking: A New Paradigm in User Experience and Financial Education

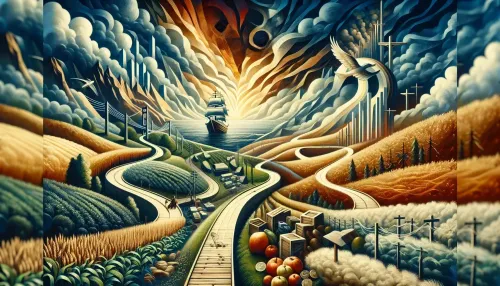

As technology marches inexorably forward, the realm of personal finance and investing joins hands with state-of-the-art advancements, promising to reimagine our interactions with money. Within this evolution, one technology stands out for its potential to revolutionize the way we think about banks and financial literacy—the immersive world of Virtual Reality (VR). The Tycoon Trail Blog delves into how VR is paving the way for a transformative experience in managing finances, offering insights into this budding financial frontier.

Gone are the days when visiting a bank meant standing in long queues and navigating the hustle and bustle of brick-and-mortar branches. The future whispers tales of immersive banking, where virtual reality branches provide personalized customer experiences from the comfort of home. Imagine donning a VR headset and stepping into a virtual bank, greeted by digital avatars of banking consultants ready to assist with your financial needs. Here, complex transactions become simple navigations through virtual spaces, making banking not only efficient but also an enchanting experience.

Immersive Banking: The Future of Virtual Reality Branches

Financial literacy has always been a cornerstone of wise investing and personal finance management. With VR, learning becomes an interactive journey rather than a static reading session. Picture a virtual classroom that simulates market scenarios, helping users understand financial principles through hands-on experience. From balancing checkbooks to crafting investment portfolios, VR-based financial education programs can teach principles of money management in an engaging environment that resonates particularly well with digital natives.

The VR Edge in Financial Literacy: Learning in a Virtual World

Imagine transforming the often intimidating world of investments into an engaging game. This is precisely what VR proposes—gamifying the investment process to make it fun and accessible to all levels of investors. Users can traverse through virtual markets, buying and selling assets as they learn about risk management and portfolio diversification. This playful immersion can demystify complex financial concepts and entice newcomers who might otherwise find traditional investment avenues daunting.

Gamifying Investments: Making Finance Fun and Accessible

The younger demographic is sometimes disengaged from conventional investing channels due to perceived complexity or lack of interest. By incorporating VR into financial platforms, institutions can engage young investors in a language they understand—immersive interactivity. As they virtually navigate through simulated economic landscapes, these young participants can cultivate a lasting interest in finance by experiencing it as an exciting adventure rather than a burdensome task.

Decision-making in investing can be fraught with uncertainty. Virtual reality proposes an innovative solution—customized financial scenarios that allow individuals to "test-drive" their investment decisions. Users can simulate various market conditions and investment strategies within a VR setting to witness potential outcomes without risking real-world capital. Such experiential learning can promote better-informed decision-making processes.

Engaging Young Investors: Virtual Reality Experiences

In an era where remote interactions have become mainstream, virtual reality steps in to elevate the experience of financial advising and consultations. VR environments allow clients and advisors to meet in dedicated virtual spaces for discussions, document reviews, and strategy planning—no physical presence required. Such convenience not only saves time but also opens up new possibilities for how advisory services are delivered and received by clients worldwide.

Related Article: The Power of Fiscal Stability: Mastering Cash Flow Management for Long-Term Solvency

Customized Financial Scenarios: Test-Driving Investment Decisions

Visualization is key to comprehending intricate datasets—a principle heavily leveraged by virtual reality for finance-related data analytics. By translating numbers into three-dimensional graphs and interactive models within VR space, individuals can grasp their financial health with unprecedented clarity. This next-level visual representation harnesses the cognitive benefits of spatial relationships and immersion, providing insights that could be easily overlooked on traditional two-dimensional dashboards.

Remote Financial Advising: Benefits of VR Consultations

Lastly, as security becomes increasingly vital in finance, virtual reality emerges as a powerful ally in fraud prevention training. Through simulated phishing attacks and scam scenarios within controlled VR environments, users can learn to recognize red flags and malicious tactics safely. This hands-on knowledge plays a crucial role in safeguarding personal finances against fraudulent activities that are becoming ever more sophisticated.

As we survey the intersection of technology and finances on the Tycoon Trail Blog, we witness an exhilarating synergy giving rise to novel methods of engagement—methods that promise not only heightened convenience but also enriched educational opportunities for all. Virtual Reality banking offers a new dimension in user experience where one's journey to financial acumen is as vibrant as it is valuable—a fitting prelude for tomorrow's savvy investor.

Frequently Asked Questions

Immersive banking in virtual reality allows users to experience banking services through virtual environments. By wearing a VR headset, customers can interact with digital avatars of banking consultants, simplifying complex transactions and providing personalized experiences from the comfort of their homes.

Virtual reality enhances financial literacy by transforming traditional learning into interactive experiences. Users can engage in simulated market scenarios that teach money management principles, such as balancing checkbooks and creating investment portfolios, making financial education more engaging and effective.

Yes, virtual reality can significantly improve remote financial advising by creating dedicated virtual spaces for client-advisor interactions. This technology allows for discussions, document reviews, and strategy planning without the need for physical presence, enhancing convenience and accessibility for clients worldwide.

Check Out These Related Articles

The Art of Raising Financially Savvy Kids: Parenting Hacks for Teaching Money Skills

The Financial Journey of Fortune Builders: Stories of Personal Finance and Investing Success

The Gig Economy Unleashed: Redefining Personal Finance for Digital Nomads