Anticipating Fiscal Shocks: Preparing Your Finances for Upcoming Tax Reforms

Understanding the Impact of Tax Reforms on Your Finances

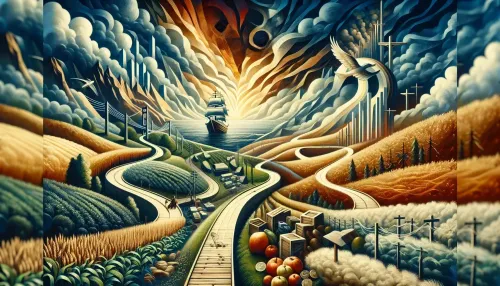

Tax reforms are often double-edged swords: while they can provide some taxpayers with relief, they may also introduce complexities that can impact your financial health. Understanding the nuances of the anticipated changes and adjusting financial strategies accordingly is critical, particularly for those conscientiously managing their personal finances and investments. The Tycoon Trail Blog is here to walk you through several facets of these reforms and guide you in fortifying your fiscal strategies.

How Proposed Tax Legislation Affects Investment Decisions

Whether you're a seasoned investor or novices taking their first steps on the path to wealth, it's important to recognize how tax legislation can alter the investing landscape. New laws could change the tax-deferent status of certain investment accounts or modify capital gains rates, which can significantly influence your decision-making process.

For starters, a hike in capital gains tax might encourage investors to seek shelter in tax-advantaged accounts, like Roth IRAs where withdrawals are tax-free. Alternatively, if reforms provide favorable treatment for investments in sustainable projects or startups, this could shift focus towards greener portfolios or venture capital.

Maximizing tax efficiency will become paramount as new tax legislation takes effect. Seek out investments that offer favorable tax treatment under the newly proposed rules. This could mean prioritizing municipal bonds for those in high-income brackets or taking advantage of increased contribution limits for certain retirement accounts.

Related Article: The Art of Raising Financially Savvy Kids: Parenting Hacks for Teaching Money Skills

Maximizing Tax-Efficient Investments Under New Policies

Tax-loss harvesting could also gain prominence, allowing investors to offset taxes on capital gains by selling underperforming assets at a loss. Understanding and leveraging these nuances in tax-efficient investing are skills readers of Tycoon Trail Blog have come to expect.

Retirement accounts are often in the crosshairs during tax reform discussions. As such revisions unfold, it's essential to reassess your retirement planning strategies. Should new laws reduce the advantages of 401(k) contributions, it might be time to weigh the benefits of after-tax contribution plans like Roth IRAs.

Retirement Fund Strategies After Tax Reform Changes

A shift in retirement fund taxation can necessitate a reevaluation of your portfolio's allocation to align better with updated rules. Keep an eye on Tycoon Trail Blog's insights on these developments to stay informed on making savvy adjustments tailored to your financial horizon.

Estate planning invariably becomes more complex with changing tax legislation. Changes could include modifications to inheritance tax thresholds or the treatment of trusts and gifts. It's crucial for individuals with estate plans to review how these changes could impact their legacy intentions and make necessary adjustments.

Working with a qualified estate planner who can interpret new regulations into actionable advice is wise.

Navigating Estate Planning Amid Tax Law Changes

Adjusting investment portfolios in response to capital gain and dividend tax reforms is a strategic imperative. If higher taxes on dividends are looming, it may push investors toward growth stocks over income-providing securities. Meanwhile, an increase in long-term capital gains taxes could discourage selling appreciated assets, leading investors to hold positions longer than they might otherwise.

Investors should consider how such adjustments align with their overall investment strategy and risk tolerance.

Capital Gains and Dividend Tax Adjustments for Investors

Personal tax planning requires nimble navigation through the maze of deduction limits and credits that inevitably evolve with tax reforms. Familiar deductions or credits may be capped or phased out entirely under new legislation. Conversely, novel opportunities might arise—such as increased deductions for educational expenses or healthcare costs.

Staying informed about these alterations is key to effective personal tax planning. Dedications remain committed to unveiling layers of complexity associated with changes in deduction policies keeping you one step ahead in managing fiscal implications personally.

Related Article: The Power of Fiscal Stability: Mastering Cash Flow Management for Long-Term Solvency

Navigating Deduction Limits and Credits in Tax Planning

Real estate remains a cornerstone investment for many portfolios, but it doesn't stand immune to the impact of tax reforms. Shifts in property tax allowances or changes in depreciation rules can affect real estate investment appeal. Proactive investors will want to anticipate potential market reactions—such as shifts towards commercial property if it garners more favorable treatment than residential real estate under new rules.

A vigilant approach towards audits and compliance checks is vital as taxation authorities become increasingly precise. Proper record-keeping goes beyond mere organization—it's a bulwark against potential penalties during audits that may become more frequent as laws change.

Leveraging accounting software that aligns with new reporting requirements or seeking professional guidance can be prudent moves ensuring serene sailing through stricter compliance tides forecasted alongside forthcoming reforms.

The Long-Term Effects of Tax Reforms on Real Estate Investments

The landscape of personal finance and investing undergoes continual metamorphosis under the relentless drift of fiscal policy changes. Keeping pace requires agility—an attribute that readers of Tycoon Trail Blog hold intrinsic to their financial endeavors. By delving into each facet presented above and preemptively adopting adaptive strategies reflective of these transformations, one can skillfully navigate the currents of fiscal change securing their financial future amidst shifting legislative sands.

Frequently Asked Questions

Investors should evaluate how proposed tax reforms might affect their investment strategies, particularly regarding capital gains taxes and the tax treatment of various accounts. Changes could lead to a shift towards tax-advantaged accounts like Roth IRAs or investments in sustainable projects, influencing overall portfolio decisions.

To maximize tax-efficient investments post-reform, individuals should seek out opportunities that align with new tax policies. This includes prioritizing investments like municipal bonds for high-income earners and utilizing strategies such as tax-loss harvesting to offset capital gains, ensuring a more favorable tax outcome.

Estate planning becomes crucial during tax reform changes because modifications to inheritance taxes and trust treatments can significantly impact legacy intentions. Individuals should review their estate plans with qualified professionals to ensure compliance with new regulations and to adjust their strategies accordingly for effective wealth transfer.

Check Out These Related Articles

Maximizing Credit Card Benefits: Hacks for Smart Spending and Rewards

The Financial Journey of Fortune Builders: Stories of Personal Finance and Investing Success

The Golden Rule of Saving: Expert Strategies to Boost Your Financial Well-being