Ethically Bankrupt? Exploring the Conscience of Corporate Banking Practices

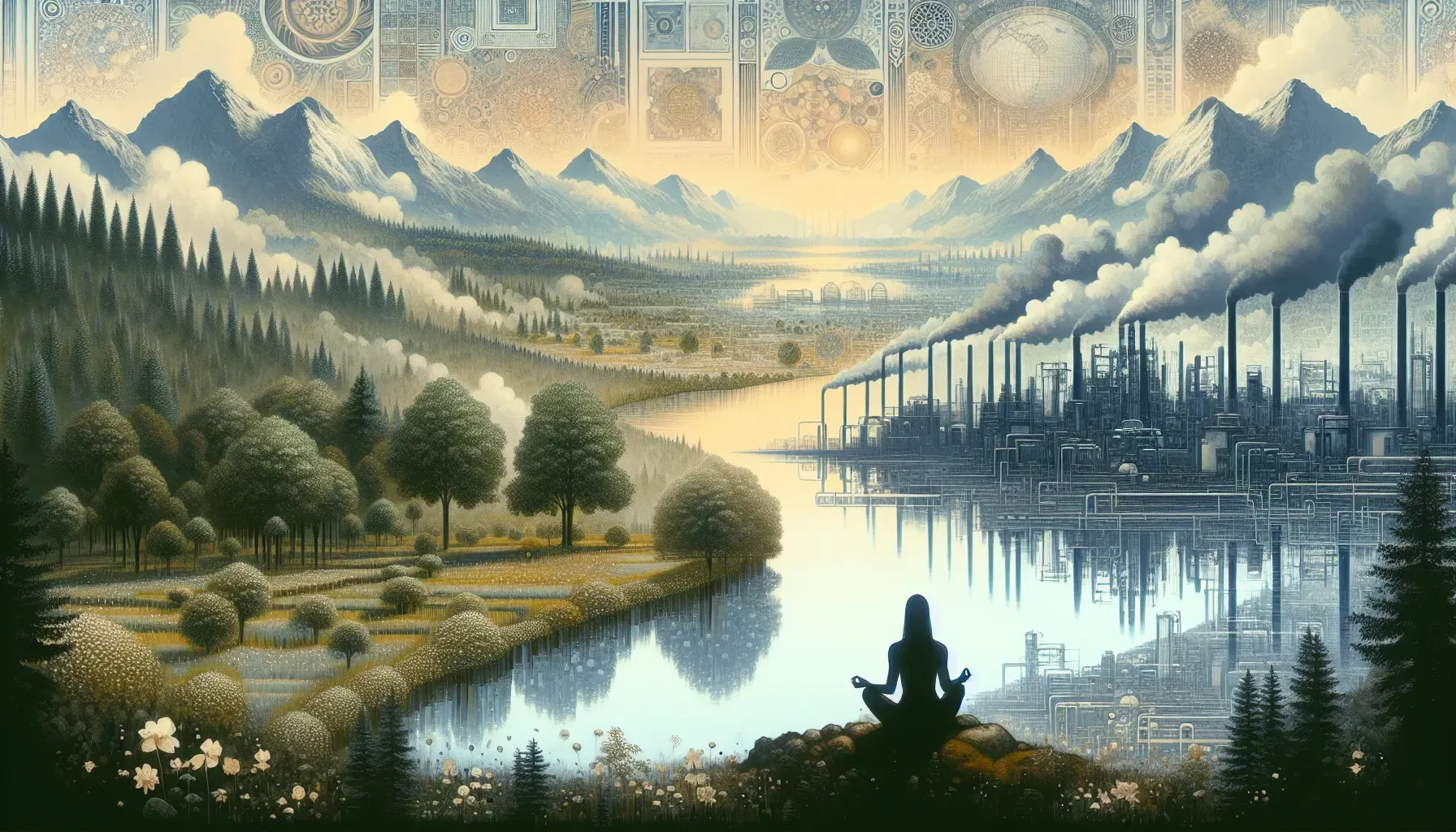

Corporate banking practices play a pivotal role in shaping economic equality and environmental stewardship. As financial entities entrusted with managing clients' wealth and investments, banks hold a profound responsibility to channel funds ethically. The ethical dimension extends beyond profit generation to encompass social impact and environmental sustainability.

Corporate Banking's Role in Economic Equality

When engaging in personal finance and investing discussions on Tycoon Trail, it's vital to address the ethical implications of banking practices. By weaving ethical considerations into financial decisions, Tycoon Trail readers can align their investments with their values while promoting responsible corporate behaviors.

Ethical Banking Practices on Tycoon Trail

Banks must be held accountable for their contributions to economic equality and environmental sustainability. They should actively support initiatives aimed at reducing income inequality, such as providing accessible financial services to underserved communities or promoting inclusive lending practices. Similarly, investing in environmentally responsible projects and integrating sustainable practices within their operations is essential for fostering a more ecologically conscious financial sector.

The age-old dilemma of profit maximization versus societal welfare haunts big banks' business models. It raises critical questions about the prioritization of financial gains over social welfare. At times, these business models may lead to unethical decisions that prioritize shareholders' profits at the expense of broader societal interests.

Related Article: Leveraging Technology: The Future of Financial Services

Evaluating Big Banks' Business Models

Big banks should reassess their profit-centric approaches and embrace business models that prioritize both financial success and ethical conduct. Aligning corporate strategies with societal well-being can yield long-term benefits by fostering trust among stakeholders, enhancing reputation, and contributing to sustainable economic growth.

Profit Maximization vs. Societal Welfare

Transparency forms the cornerstone of ethical corporate conduct. Clients entrust banks with their hard-earned resources, making honesty and openness non-negotiable virtues in the banking industry. Lack of transparency can lead to misaligned incentives, financial exploitation, and erosion of clients' trust.

Reassessing Profit-Centric Approaches

Banks owe their clients comprehensive and unambiguous disclosures regarding their financial products, services, risks involved, and fees charged. Ethical banking practices mandate clear communication on investment strategies, potential conflicts of interest, and any affiliations that might influence the bank's recommendations. By upholding transparency standards, banks foster trust among clients and demonstrate their commitment to ethical conduct.

Related Article: Redefining Financial Services: The Role of Fintech Disruptors in Reshaping Consumer Experience

The Importance of Transparency in Banking

The rise of sustainable banking initiatives has spurred discussions on whether these endeavors represent genuine strides towards environmental consciousness or mere greenwashing tactics. Genuine commitments to sustainability entail tangible actions aimed at minimizing environmental impacts, supporting eco-friendly projects, and incorporating sustainable principles into core operational frameworks.

Honesty and Openness in Client Relations

Tycoon Trail can leverage its platform to feature sustainable financial products offered by ethical banks. This provides an opportunity for affiliate marketing while promoting environmentally responsible banking options to its readership.

Related Article: Adapting to Evolving Regulatory Environments in Finance

Sustainable Banking Initiatives: Reality or Greenwashing?

Ethical banking institutions must steer clear of greenwashing by ensuring that their sustainability pledges translate into measurable outcomes—a move that resonates with conscientious investors seeking genuine environmental commitment from financial institutions.

The advocacy for fair banking policies rests on the premise that consumers have the right to transparent, equitable, and trustworthy banking services. Meanwhile, banks must navigate a landscape where regulatory compliance intersects with profit motives—sometimes at the expense of consumer interests.

Collaborative Marketing of Sustainable Products

Promoting fair banking policies necessitates striking a balance between regulatory adherence and consumer-centric practices. This involves advocating for robust consumer protection laws, promoting fair lending practices, upholding customer privacy rights, and combating predatory financial behaviors in alignment with ethical tenets.

Related Article: Unveiling the Fusion of Technology and Personal Finance Careers: Exploring Fintech Opportunities

Advocating for Fair Banking Policies

In pursuit of ethical personal finance solutions, individuals are increasingly exploring alternative banking options beyond traditional financial institutions. Ethical considerations prompt a quest for diverse financial avenues—ranging from community banks and credit unions to fintech platforms offering socially responsible banking services.

The Balance Between Consumer Rights and Corporate Gains

By acknowledging alternative banking options through an ethical lens, individuals can align their financial choices with broader societal values while supporting endeavors committed to ethical financial stewardship.

Unpacking the conscience of corporate banking practices reveals a complex interplay between profitability aspirations and ethical imperatives within the personal finance landscape. The accountability of banks in fostering economic equality, transparent dealings with clients, adherence to sustainability commitments, advocacy for fair banking policies, and exploration of ethical alternatives shapes a crucial narrative in the pursuit of ethically sound personal finance decisions.

Frequently Asked Questions

Ethical banking practices involve managing financial resources in a way that prioritizes social impact and environmental sustainability. This includes providing accessible financial services to underserved communities, promoting inclusive lending, and investing in environmentally responsible projects. By aligning financial decisions with ethical considerations, banks can contribute to economic equality and foster trust among clients.

Big banks should reconsider profit-centric models because prioritizing shareholder profits can lead to unethical decisions that harm societal welfare. Embracing business strategies that balance financial success with ethical conduct can enhance trust among stakeholders, improve reputations, and contribute to sustainable economic growth, ultimately benefiting both the banks and the communities they serve.

Transparency and honesty are crucial for building client trust in banks. Clients expect clear communication regarding financial products, risks, and fees. When banks provide comprehensive disclosures and maintain open lines of communication, they foster trust and demonstrate a commitment to ethical practices, which is essential for long-term client relationships.

Greenwashing refers to the practice where banks or financial institutions promote themselves as environmentally friendly without implementing genuine sustainable practices. It involves making misleading claims about their environmental efforts to attract conscientious investors while failing to deliver measurable outcomes. Genuine sustainability requires tangible actions that minimize environmental impacts and support eco-friendly projects.

Alternatives to traditional banking include community banks, credit unions, and fintech platforms that offer socially responsible banking services. These options often prioritize ethical considerations and community development over profit maximization, allowing individuals to align their financial choices with broader societal values while supporting initiatives committed to ethical stewardship.

Check Out These Related Articles

Fintech at a Crossroads: How Emerging Regulations are Shaping the Future of Digital Banking and Online Investments

The New Era of Customer Experience in Finance: Leveraging VR and AR for Immersive Advising

Fintech Ventures that Matter: Powering Underbanked Communities Towards Economic Inclusion