Redefining Financial Empowerment: Activists' Impact on Personal Finance Paradigms

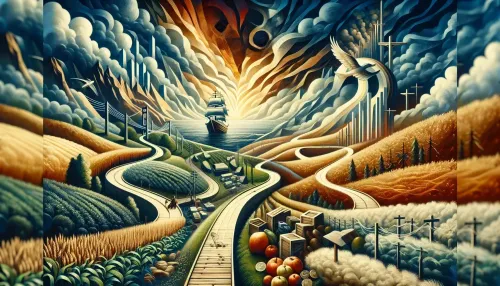

In recent years, a profound shift has reverberated through the personal finance and investing landscape. Traditional notions of wealth management and investment strategies have been challenged by a wave of progressive ideologies championed by activists seeking to redefine financial empowerment. Their influence extends beyond conventional investment wisdom, encompassing issues of gender equality, socioeconomic disparities, financial wellness, environmental advocacy, cultural taboos, and collaborative economic development. In this article, we delve into the transformative impact of activists on personal finance paradigms, exploring their role in challenging the status quo and fostering positive change.

The traditional approach to investment often rests on principles that emphasize individual gains without acknowledging broader societal implications. However, activists have been instrumental in advocating for a paradigm shift that incorporates progressive ideologies into investment decision-making. By challenging conventional wisdom, they have elevated considerations such as ethical investment, impact investing, and socially responsible practices. These movements have reshaped the discourse surrounding investment strategies, amplifying the importance of aligning financial decisions with values that extend beyond monetary returns.

Challenging Conventional Investment Wisdom

Empowering individuals to take control of their financial futures lies at the core of activist-driven initiatives. Grassroots movements focused on financial literacy, education, and inclusion have paved the way for cultivating financial confidence and autonomy among diverse communities. Through educational workshops, mentorship programs, and accessible resources, activists have fostered an environment where individuals can make informed decisions and navigate the complex terrain of personal finance with greater assurance.

Cultivating Financial Confidence and Autonomy

Addressing gender disparities in wealth management and resource allocation has emerged as a pivotal focus for activists within the personal finance sphere. By advocating for equal access to financial opportunities, dismantling systemic barriers, and promoting diverse representation in decision-making roles within the financial sector, activists are working towards leveling the playing field. Their efforts are instrumental in driving meaningful change that resonates across generations and fosters an environment where financial prosperity is not bound by gender biases.

Advocating for Gender Equality in Wealth Management

Socioeconomic disparities often dictate access to capital and financial opportunities. Activists have propelled initiatives aimed at dismantling these barriers by mobilizing resources and advocating for inclusive financial systems. By addressing systemic inequalities through targeted policies, impact-driven investments, and community-led programs, these efforts have sought to narrow the gap in access to capital while creating pathways for economic mobility and prosperity among historically marginalized communities.

The advocacy for financial wellness as a fundamental human right has gained momentum within activist circles. Beyond monetary considerations, activists are championing holistic approaches to financial well-being that encompass mental health, educational equity in finance, and affordable access to essential financial services. By elevating conversations around financial wellness as an inherent right, these movements are reshaping societal attitudes towards personal finance while spearheading initiatives aimed at creating inclusive environments conducive to overall prosperity.

Mobilizing Resources to Address Socioeconomic Disparities

Environmental advocacy has become increasingly intertwined with investment decision-making as activists emphasize the significance of sustainable and eco-conscious practices. By integrating environmental considerations into investment strategies through avenues such as green investing, impact funds dedicated to ecological preservation, and divestment from environmentally detrimental industries, activists are influencing a paradigm shift towards environmentally responsible wealth management practices.

Related Article: The Art of Raising Financially Savvy Kids: Parenting Hacks for Teaching Money Skills

Promoting Financial Wellness as a Human Right

Cultural taboos surrounding money matters can pose significant obstacles to open dialogue and inclusive participation in financial discussions. Activists are actively engaged in dismantling these taboos by fostering culturally sensitive approaches to financial empowerment. By nurturing spaces for nuanced conversations about money within diverse cultural contexts and challenging stigmas associated with financial discussions, these initiatives are forging pathways towards greater inclusivity within the realm of personal finance.

Integrating Environmental Advocacy into Investments

Collaborative economic development underscored by equitable wealth distribution has emerged as a cornerstone of activist endeavors within personal finance paradigms. By fostering partnerships between diverse stakeholders, advocating for fair economic policies, and promoting initiatives that prioritize community wealth-building, activists are catalyzing sustainable economic growth while striving to dismantle structures that perpetuate wealth inequality.

Incorporating progressive ideologies into personal finance paradigms reflects a concerted effort to redefine financial empowerment beyond individual gain. The multifaceted impact of activists spans an array of domains including investment strategies, gender equality in wealth management, socioeconomic disparities in access to capital, environmental advocacy integration into investment decisions, cultural inclusivity in money matters, and collaborative economic development. As these transformative movements continue to gain momentum, they usher in a new era of conscientious wealth management rooted in progressive values and inclusive prosperity. Tycoon Trail remains committed to illuminating these paradigm shifts shaping the future of personal finance.

Frequently Asked Questions

Activists are challenging traditional investment strategies by promoting progressive ideologies that focus on ethical and socially responsible practices. Their influence encourages individuals to align financial decisions with broader societal values, fostering a more inclusive approach to wealth management that transcends mere monetary gains.

Grassroots movements led by activists focus on enhancing financial literacy and inclusion through workshops and mentorship programs. These initiatives empower individuals from diverse backgrounds to take control of their financial futures, enabling them to make informed decisions and navigate personal finance with greater confidence and autonomy.

Collaboration among diverse stakeholders is crucial for fostering equitable wealth distribution and sustainable economic growth. Activists advocate for fair economic policies and community wealth-building initiatives, aiming to dismantle structures that perpetuate inequality while promoting partnerships that drive positive change within the financial landscape.

Check Out These Related Articles

The Financial Journey of Fortune Builders: Stories of Personal Finance and Investing Success

Bridging Budgets and Beauty: The Surprising Influence of Personal Finance on the Cosmetics Industry

Conquering Credit: Mastering the Mechanics and Benefits of Good Credit Scores